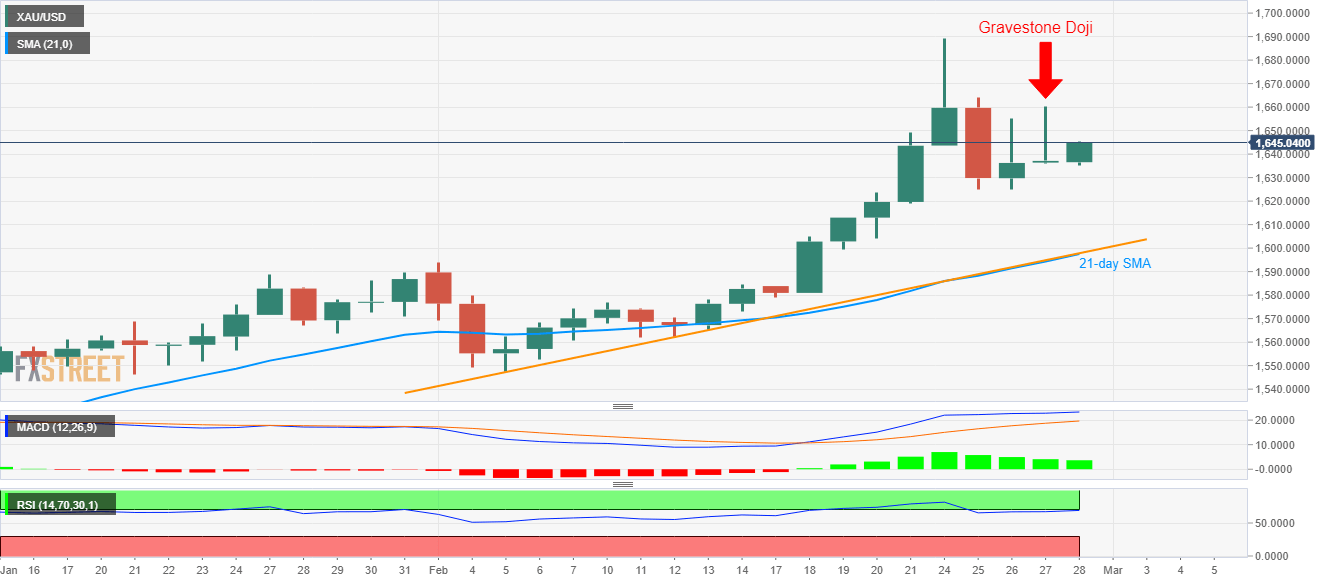

Gold Price Analysis: Gravestone Doji on D1 questions the bulls

- Gold prices remain positive.

- A bearish candlestick formation, overbought RSI check the buyers.

- The confluence of 21-day SMA, a three-week-old rising trend line acts as strong support.

- Buyers will look for entry beyond $1,661.

Gold prices take the bids near $1,645 during the initial hours of Asian trading on Friday. In doing so, the pair challenges the previous day’s bearish candlestick formation that raises hopes of a pullback until defied. Also challenging the bulls are overbought conditions of RSI.

That said, the buyers should look for entry only beyond $1,661 as it will defy the bearish candlestick on the daily (D1) chart.

Following that, the bullion can take aim at the recent highs near $1,690 and $1,697 numbers to the north before targeting the $1,700 round-figures.

On the downside, lows marked on Tuesday and Wednesday surrounding $1,625 can entertain short-term sellers.

Though, buyers are less likely to accept the defeat unless the quote breaks below 21-day SMA and short-term rising support line, around $1,598/97.

Gold daily chart

Trend: Pullback expected